Oct, 26 2025

Oct, 26 2025

NRI Mutual Fund Fee Calculator

Compare Total Investment Costs Across Top Apps

See how fees impact your NRI mutual fund investments. Enter your investment details below to calculate costs for Groww, Paytm Money, Angel One, and Zerodha Coin.

Note: These calculations are based on standard fees from the article. Actual fees may vary slightly. Always check the current rate chart on the app before investing.

Key Takeaways

- Four apps dominate the NRI mutual‑fund space in 2025: Groww, Paytm Money, Angel One, and Zerodha Coin.

- All four are SEBI‑registered, support the Liberalised Remittance Scheme (LRS) and let you link an NRE/NRO bank account.

- Fees, fund coverage and UI differ - choose based on cost sensitivity, fund variety you need, and how much you value in‑app research.

- Watch out for hidden conversion charges and KYC renewal reminders; they can erode returns over time.

- Start with a modest SIP, track performance for three months, then scale up once you’re comfortable with the app’s workflow.

For NRIs, the biggest hurdle to buying Indian mutual funds isn’t the market itself - it’s finding a platform that respects cross‑border regulations, offers smooth currency conversion, and puts the right data in your hands. If you’re hunting for the best NRI mutual fund app, you’ve landed in the right spot. Below is a step‑by‑step walk‑through of the top choices, the rules they obey, and the exact process you’ll follow from registration to your first SIP.

Understanding the NRI Landscape

When you see the term “NRI” in the context of Indian mutual funds, two things instantly matter: the Liberalised Remittance Scheme (LRS) and the SEBI (Securities and Exchange Board of India) regulations that govern foreign investor participation. LRS lets an Indian resident remit up to USD 250,000 per financial year for investment, education, or medical purposes. As an NRI, you’ll typically use an NRE (Non‑Resident External) or NRO (Non‑Resident Ordinary) account, both of which are foreign‑exchange‑managed and fully convertible back to your home currency.

SEBI’s key requirement is that every NRI must complete a KYC (Know Your Customer) process that includes proof of overseas address, passport copy, and a recent photograph. The good news? Most modern apps now embed a video‑KYC flow that finishes in under five minutes.

What Makes an App "Best" for NRIs?

We’ve boiled the criteria down to five practical pillars:

- Regulatory compliance: The platform must be SEBI‑registered and support LRS, NRE/NRO accounts.

- Currency conversion & fees: Transparent FX rates, low conversion charges, and a clear fee structure for purchases, redemptions, and SIPs.

- Fund universe: Access to both large‑cap and niche schemes, especially those offered by top Asset Management Companies (AMCs) like HDFC, ICICI, and Nippon.

- User experience: Intuitive UI, real‑time NAV updates, and robust portfolio analytics.

- Support & documentation: Dedicated NRI helpdesk, multi‑language support, and clear tax‑implication guides.

Every app we review checks the compliance box. The real differences lie in the rest - especially fees and fund coverage.

Top Four NRI Mutual Fund Apps in 2025

Below is a snapshot of the four platforms that consistently rank highest among NRIs living abroad. Each entry starts with a micro‑data definition so search engines can pick them up as distinct entities.

| App | Regulatory Status | Currency Conversion Fee | Fund Coverage (# of schemes) | Annual Platform Charge | Best For |

|---|---|---|---|---|---|

| Groww | SEBI‑registered, LRS enabled | 0.25% + live FX spread | ≈ 3,200 | 0.20% on assets > ₹1 Lakh | Beginner‑friendly UI |

| Paytm Money | SEBI‑registered, LRS enabled | 0.30% flat | ≈ 2,900 | Free for SIPs, 0.15% on lump sums | Low‑cost SIPs |

| Angel One | SEBI‑registered, LRS enabled | 0.20% + spread | ≈ 3,100 | 0.35% on holdings | Advanced research tools |

| Zerodha Coin | SEBI‑registered, LRS enabled | 0.18% + spread | ≈ 3,000 | Free on direct plans, 0.10% on regular plans | Direct‑plan enthusiasts |

Deep Dive: How Each App Handles the NRI Workflow

1. Groww

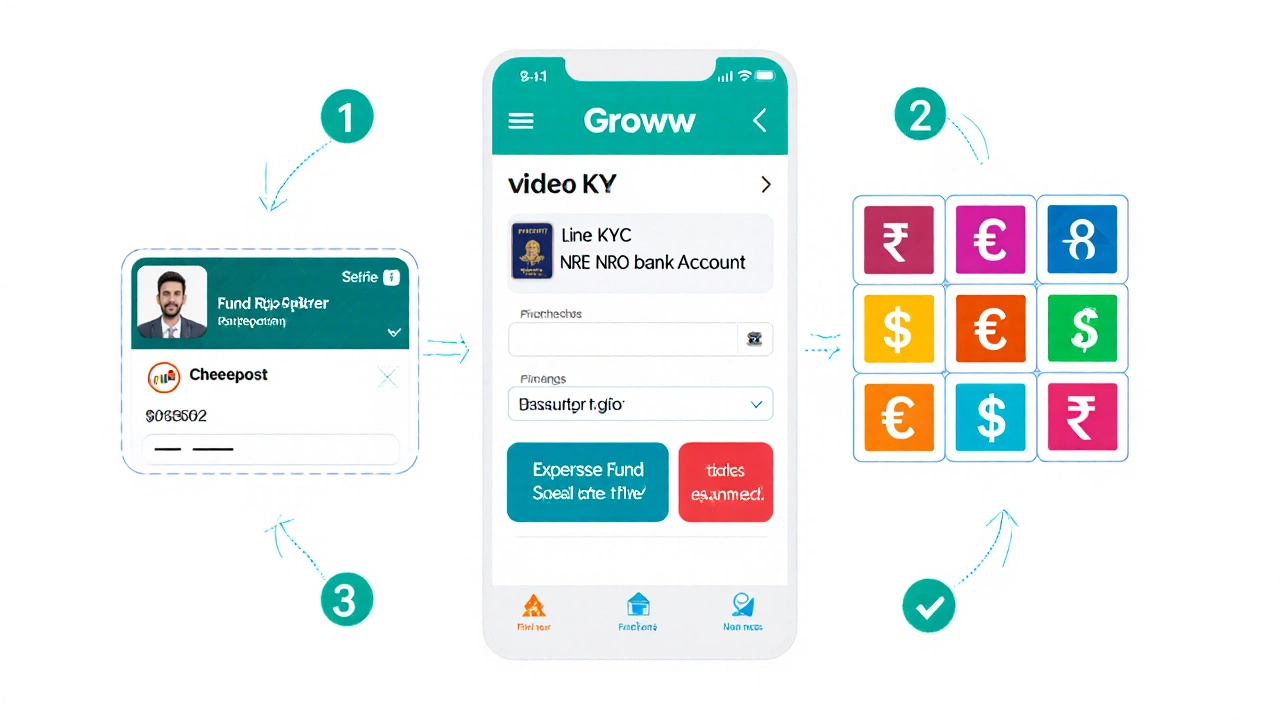

Groww’s onboarding flow starts with a simple phone‑number verification, then pivots to a video‑KYC that accepts a passport copy and overseas address proof. Once approved, you can link an NRE/NRO bank account directly within the app. Currency conversion happens instantly at the inter‑bank rate, with the 0.25% fee automatically deducted.

One standout feature is the “Fund Explorer” - a filterable grid that shows every scheme, its expense ratio, and past 5‑year returns. Groww also pushes a monthly performance email in your local time zone, making it easy to keep track without logging in every day.

2. Paytm Money

Paytm Money leverages its massive payments ecosystem, so if you already use Paytm in India you’ll feel at home. The NRI KYC is done via a live video call with a Paytm representative - a bit more formal but still under ten minutes.

What makes Paytm Money attractive is the “Zero‑Commission SIP” on over 2,500 direct‑plan funds. The app’s “Tax Toolkit” auto‑calculates the TDS (Tax Deducted at Source) for NRO accounts, which is a common pain point for NRIs.

3. Angel One

Angel One (formerly Angel Broking) offers a more broker‑centric experience. After KYC, you receive a “Demat‑plus‑mutual‑fund” account that lets you hold both equities and funds under one login.

Its research portal, “Angel Research”, provides analyst ratings, sector outlooks, and a “Fund Rating” score that aggregates risk, consistency, and expense ratio. The platform charges a modest 0.35% annual fee on holdings, which is higher than Groww but justified by the depth of insights.

4. Zerodha Coin

Zerodha is famous for low‑cost equity trading, and Coin extends that philosophy to mutual funds. The app only supports direct‑plan purchases, which means you bypass the distributor’s cut (usually 0.5%-1%).

The conversion fee is the lowest on our list at 0.18%, and there’s no annual platform charge for direct plans. If you’re a cost‑sensitive investor who already uses Zerodha for stocks, Coin feels like a natural extension.

Step‑by‑Step Guide: Buying Your First Mutual Fund as an NRI

- Choose the app that fits your style. Use the comparison table above to shortlist.

- Complete KYC. Have your passport, overseas address proof, and a selfie ready. Most apps accept a video call or upload.

- Link an NRE/NRO account. You’ll need your bank’s IFSC code and a photocopy of the cancelled cheque.

- Fund your account. Transfer INR (via your NRE/NRO account) or send USD that the app will convert at the quoted FX rate.

- Select a scheme. For beginners, a diversified large‑cap fund like HDFC Top 100 or an ELSS (tax‑saving) fund is a safe start.

- Set up a SIP. Most apps let you choose an amount as low as ₹500 per month. This automates discipline.

- Monitor and rebalance. Use the app’s portfolio dashboard to see NAV changes, expense ratios, and tax impact.

Typical timeline: KYC (5 min) → bank link (3 min) → fund transfer (instant for NRE) → purchase (under a minute). In total, you can be fully invested in less than 15 minutes.

Hidden Costs You Should Watch Out For

Even the “free” apps can sneak in fees that bite into returns. Here’s a quick checklist:

- FX spread: Some apps quote a rate that’s slightly worse than the inter‑bank rate. Compare the “live” rate shown in the app with a reliable source like Reuters.

- Redemption charge: Certain funds levy a short‑term exit fee if you sell within 30 days. The app will usually display it, but read the scheme’s offer document.

- Account inactivity fee: If you go six months without a transaction, a modest ₹200 fee may apply on some platforms.

- Tax filing assistance: While most apps give you a TDS certificate, they may charge extra for a detailed tax‑return filing service.

Regulatory Updates to Keep on Your Radar

SEBI announced in July 2025 a new guideline that allows NRIs to invest in certain “category‑II” funds without the 12‑month lock‑in period that previously applied to foreign investors. This change expands the pool of high‑growth thematic funds you can access through the apps listed above.

Also, the RBI is reviewing the LRS ceiling. If the limit drops below USD 250,000, you’ll need to split larger investments across multiple financial years - a detail that can affect long‑term SIP planning.

Final Verdict: Which App Wins for Which NRI?

There is no one‑size‑fits‑all answer, but here’s a quick match‑up:

| Investor Profile | Recommended App | Why |

|---|---|---|

| First‑time NRI investor, wants a clean UI | Groww | Simple onboarding, extensive fund list, good educational resources. |

| Cost‑conscious SIP enthusiast | Paytm Money | Zero‑commission SIPs, low conversion fee, built‑in tax toolkit. |

| Investor who also trades stocks | Angel One | Combined Demat‑plus‑fund account, deep research, broker support. |

| Experienced investor chasing lowest fees | Zerodha Coin | Direct‑plan only, minimal FX charge, no annual platform fee. |

Pick the app that matches your priority, run a small test investment, and then scale up once you feel comfortable with the platform’s flow and fee structure.

Quick Troubleshooting Guide

- KYC stuck? Verify that your passport scan is clear and that the selfie shows your face fully. Re‑upload if the app flags a mismatch.

- Currency conversion looks high? Refresh the conversion screen; most apps lock the rate for 5‑10 minutes only.

- Unable to link NRE/NRO account? Make sure the bank’s IFSC code is correct and the account is a "foreign‑exchange‑managed" type. Contact the app’s NRI support line.

- Unexpected TDS on redemption? Check whether the fund is categorized under “NRO” - TDS applies at 30% unless you submit a Form 15G/15H.

Can an NRI invest in mutual funds through a regular Indian brokerage app?

Yes. Most modern brokerage apps support the Liberalised Remittance Scheme, allowing NRIs to open an NRE/NRO linked account and invest in both direct and regular mutual fund plans.

What’s the difference between an NRE and an NRO account for fund investments?

NRE accounts are fully repatriable and tax‑free on interest, making them ideal for overseas earnings you want to bring back. NRO accounts can hold Indian‑source income, but withdrawals are subject to tax and partial repatriation limits.

Do I need to file Indian tax returns if I invest via an NRE account?

Generally no, because capital gains and dividends from mutual funds held in an NRE account are tax‑exempt in India. However, you must still report the holdings in your home‑country tax filing if required.

Is there a limit on how much I can invest each year?

The LRS caps foreign‑exchange remittances at USD 250,000 per financial year. Within that limit, you can invest any amount in mutual funds, as long as the receiving bank accepts the transfer.

Which app offers the lowest overall cost for a 5‑year SIP?

For a pure SIP the cheapest option is Zerodha Coin, thanks to its direct‑plan focus and sub‑0.2% FX charge. Paytm Money comes a close second with zero‑commission SIPs, but its flat conversion fee is slightly higher.